0

Fund 1

Fund 2

Fund 3

Fund 4

Contact us

Contact Nuveen

Thank You

Thank you for your message. We will contact you shortly.

Listen to this insight

~ 5 minutes long

Key takeaways

- Municipals were steady, returning 0.22% through Thursday's close.

- GDP growth slowed and core inflation was elevated. We think two rate cuts are still in play, although FOMC minutes lacked consensus.

- NYC's preliminary 2027 fiscal budget proposes property tax increases and reserve fund draws absent state approval for higher income taxes.

- The Supreme Court decided against use of the IEEPA to impose tariffs. Uncertainty could lead to short-term market volatility. We do not expect broad impact to municipal credit.

Market recap

Municipals posted another positive week of returns, and high yield munis outperformed. The FOMC meeting highlighted recent relatively stable labor data and dwindling support for rate cuts. GDP grew at 1.4% while Core PCE was higher than expected. Treasury rates were on the move. We anticipate rate cuts even though inflation remains elevated. NYC Mayor Mamdani opened budget negotiations with an aggressive gambit intended to pressure New York Governor Hochul. The city's revenues remain strong, and personal income tax revenues are expected to increase. Draining reserves would be negative for credit, and negotiations will continue ahead of the July 1 deadline. We expect the final NYC budget will differ materially.

How is supply trending?

Last week's supply moderated to $7.3B, but YTD supply is still tracking 3% above last year.

Market impact: Most deals had strong demand last week, although some deals shorter on the curve had lower subscription levels as investor flows continue to favor intermediate-to-long maturities.

What do yields look like?

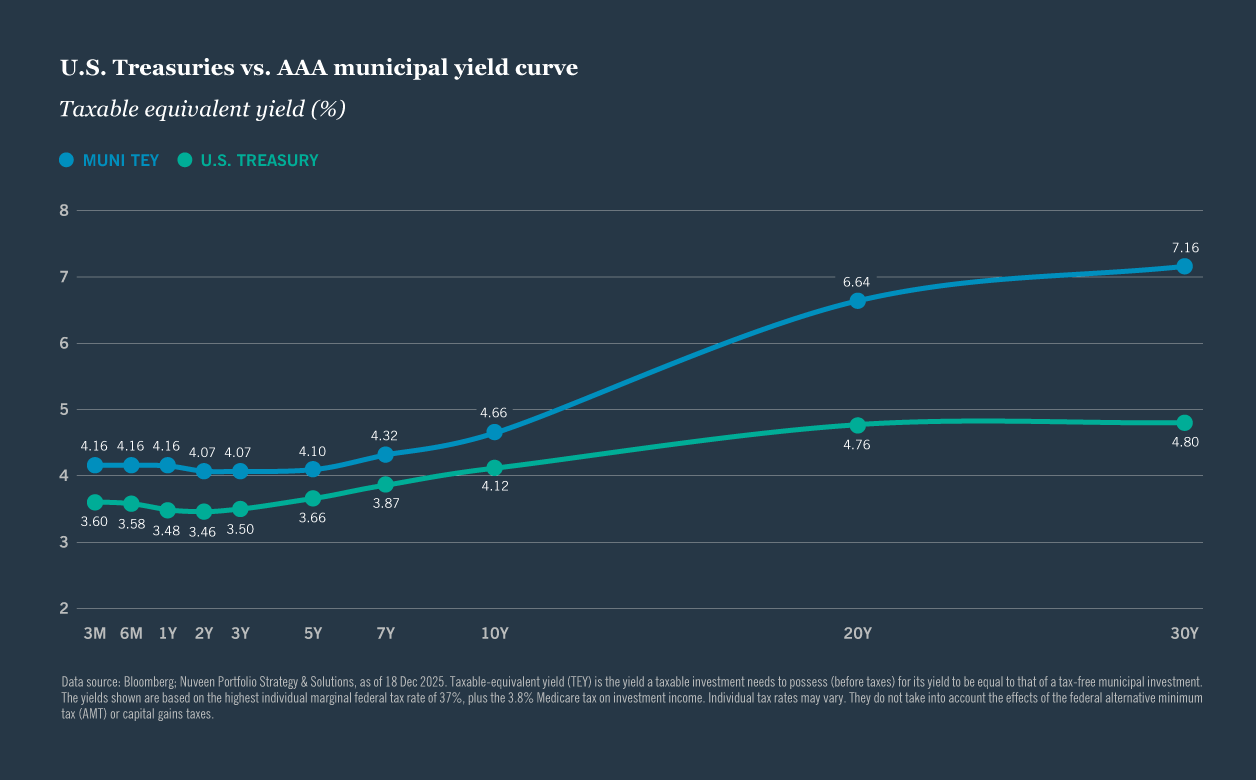

Yields fell and the curve flattened as longer-term bonds outperformed. Steepness remains attractive longer out on the yield curve.

| Municipal market yield (%) | Current (%) | Change (bps) | Ratio (%) |

|---|---|---|---|

| 5-year | 2.13 | -1 | 59% |

| 10-year | 2.52 | -1 | 62% |

| 30-year | 4.23 | -3 | 90% |

| Source: MMD, Bloomberg, L.P.; data from 13 Feb 2026–19 Feb 2026. | |||

What are flows doing?

Munis gathered $1.3B last week. So far this year, flows have outpaced 2025 by 139%.

| OEFs | +$591M | ||

| ETFs | +$679M | ||

| Long-term Funds | +$527M | ||

| High Yield Funds | +$304M | ||

| Source: LSEG Lipper, data from 12 Feb 2026–19 Feb 2026. | |||

Longer-maturity municipals have offered meaningfully higher tax-efficient yields.

Related articles

What muni bond investors should know about LA's wildfire recovery, California's revenue volatility and Chicago's fiscal pressures.

California's billionaire tax proposal faces major hurdles. We expect minimal credit impact even if the measure passes and survives challenges.

Diversifying a portfolio with municipal bonds may help reduce overall portfolio volatility.

Endnotes

Sources

Performance: Bloomberg, L.P. Issuance: J.P. Morgan, 19 Feb 2026. Fund flows: Lipper.

Any reference to credit ratings refers to the highest rating given by one of the following national rating agencies: S&P, Moody’s or Fitch. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or investment strategy, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Representative indexes: muni bond 5-year: Bloomberg Municipal Bond 5 Year (4–6) Index; muni bond 10-year: Bloomberg Municipal Bond 10 Year (8–12) Index; muni bond 15-year: Bloomberg Municipal Bond 15 Year (12–17) Index; muni long bond: Bloomberg Municipal Long Bond (22+) Index; muni bond 3–15 year blend: Bloomberg Municipal 3–15 year blend (2–17) Index; muni AAA: Bloomberg Municipal AAA Index; muni AA: Bloomberg Municipal AA Index; muni A: Bloomberg Municipal A Index; muni BBB: Bloomberg Municipal BBB Index; municipal bond: Bloomberg Municipal Bond Index; muni high yield: Bloomberg High Yield Municipal Index; U.S. aggregate bond: Bloomberg U.S. Aggregate Bond Index; U.S. Treasury: Bloomberg U.S. Treasury Index; U.S. government related: Bloomberg U.S. Government-Related Index; U.S. corporate investment grade: Bloomberg U.S. Corporate Index; U.S. high yield corporate: Bloomberg U.S. Corporate High Yield Index.

This material, along with any views and opinions expressed within, are presented for informational and educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as changing market, economic, political, or other conditions, legal and regulatory developments, additional risks and uncertainties and may not come to pass. There is no promise, representation, or warranty (express or implied) as to the past, future, or current accuracy, reliability or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such. This material should not be regarded by the recipients as a substitute for the exercise of their own judgment. It is important to review your investment objectives, risk tolerance and liquidity needs before choosing an investment style or manager.

This material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections, forecasts, estimates of yields and/or market returns, and proposed or expected portfolio composition. No representation is made that the performance presented will be achieved, or that every assumption made in achieving, calculating or presenting either the forward-looking information or the historical performance information herein has been considered or stated in preparing this material. Any changes to assumptions that may have been made in preparing this material could have a material impact on any of the data and/or information presented herein by way of example.

For term definitions and index descriptions, please access the glossary on nuveen.com. Please note, it is not possible to invest directly in an index.

Important information on risk

Past performance is no guarantee of future results. All investments carry a certain degree of risk, including the possible loss of principal, and there is no assurance that an investment will provide positive performance over any period of time. Certain products and services may not be available to all entities or persons. There is no guarantee that investment objectives will be achieved.

Investing in fixed income investments and municipal bonds involves risks such as market risk, credit risk, interest rate/duration risk, call risk, tax risk, political and economic risk, derivatives risk, and income risk. Credit risk refers to an issuers ability to make interest and principal payments when due. Typically, the value of, and income generated by, fixed income investments will decrease,or increase based on changes in market interest rates. As interest rates rise, bond prices fall and as interest rates fall, bond prices rise. Income is only one component of performance and investors should consider all of the risk factors for an asset class before investing.

Income from municipal bonds is generally exempt from regular federal income tax and may be subject to state and local taxes, based on the investor’s state of residence, as well as to the federal alternative minimum tax (AMT). Capital gains, if any, are subject to tax. Income from municipal bonds could be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the Internal Revenue Service or state tax authorities, or noncompliant conduct of a bond issuer. Please contact a tax professional regarding the suitability of tax-exempt investments as this information should not replace a client’s consultation with a financial/tax professional regarding their tax situation. Nuveen and its investment specialists do not provide tax advice.

Taxable-equivalent yields are based on the highest individual marginal federal tax rate of 37%, plus the 3.8% Medicare tax on investment income. Individual tax rates may vary.

Nuveen, LLC provides investment solutions through its investment specialists.

This information does not constitute investment research as defined under MiFID.

Contact us

Financial professionals

Individual investors

You are on the site for: Financial Professionals and Individual Investors. You can switch to the site for: Institutional Investors or Global Investors

Please be advised, this content is restricted to financial professional access only.

Login or register as a financial professional to gain access to this information.

or

Not registered yet? Register