1 Cerulli Associates, The Cerulli Report, U.S. Managed Accounts 2025. Data as of 31 Dec 2024, updated annually. Based on total assets; includes model separate accounts and proprietary assets.

2 Pensions & Investments, 16 Jun 2026, updated annually: most recent data available. Rankings based on total worldwide assets as of 31 Dec 2024 reported by each responding asset manager, with 369 firms responding.

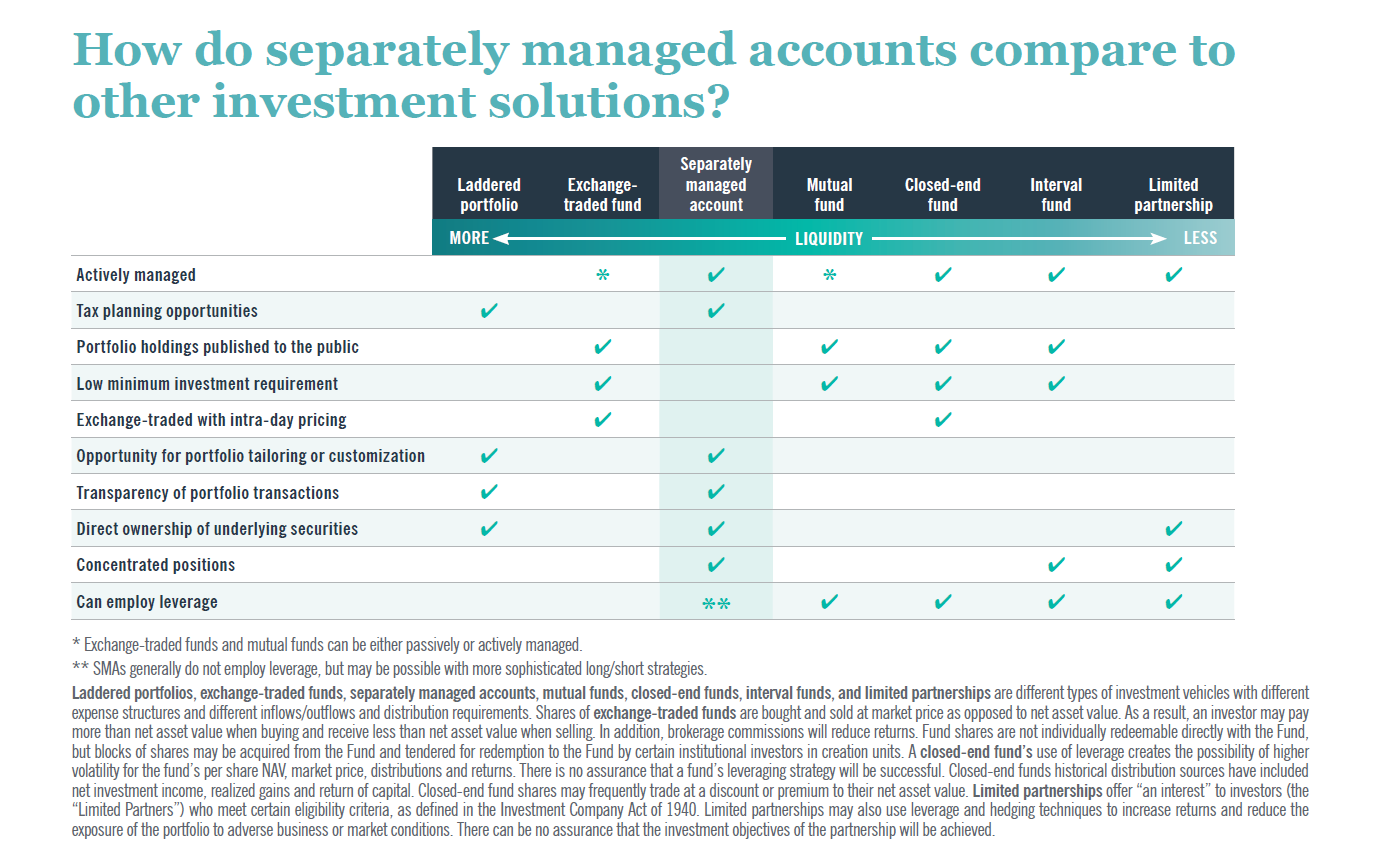

A separately managed account (SMA) is a private portfolio of actively managed, individual securities that may be customized to achieve an individual investor's unique objectives.

SMA accounts typically require a minimum investment of $100,000 for equity and asset allocation strategies and $250,000 for fixed income strategies, although the specific minimum account size varies by program and may be subject to change. The manager may waive these minimums based on client type, asset class, pre-existing relationship with client and other factors. For certain accounts, a negotiated minimum annual fee applies. Please consult with your Nuveen Advisor Consultant for applicable minimums.

Check with your financial professional for specific product availability and performance information. This information may change without notice. From time to time, we may close or reopen strategies.

Important information on risk

Past performance is no guarantee of future results. All investments carry a certain degree of risk, including the possible loss of principal, and there is no assurance that an investment will provide positive performance over any period of time. Certain products and services may not be available to all entities or persons. There is no guarantee that investment objectives will be achieved.

Although this material contains general tax information, it should not replace an investor’s consultation with a professional advisor regarding their tax situation. Nuveen is not a tax advisor. Investors should consult with their legal and tax advisors regarding their personal circumstances.

Nuveen Asset Management, LLC, and Winslow Capital Management, LLC are registered investment advisers and investment specialists of Nuveen, LLC. The investment advisory services, strategies and expertise of TIAA Investments, a division of Nuveen, are provided by Teachers Advisors, LLC and TIAA-CREF Investment Management, LLC.

Brooklyn Investment Group, LLC is an SEC registered investment adviser and a wholly-owned subsidiary of Brooklyn Artificial Intelligence, Inc. Brooklyn Investment Group, LLC (“Brooklyn”) and its parent company Brooklyn Artificial Intelligence, Inc. are subsidiaries of Nuveen, LLC, a subsidiary of Teachers Insurance and Annuity Association of America (also known as “TIAA”). Brooklyn is an affiliated investment adviser of Nuveen Asset Management, LLC (“NAM”). NAM and Brooklyn have entered into subadvisory arrangements for certain retail separately managed account strategies. Under Subadvisory arrangements, Brooklyn may provide overlay and equity discretionary portfolio management services and Nuveen may provide fixed income portfolio management services. Certain strategies may be offered on a parallel basis such that the same offering is accessible through either Nuveen or Brooklyn. While such parallel strategy offerings are substantially similar from an investment standpoint, there are operational, servicing and other differences depending on which firm they accessed through and each firm has its own separate and distinct marketing materials.