0

Fund 1

Fund 2

Fund 3

Fund 4

Contact us

Contact Nuveen

Thank You

Thank you for your message. We will contact you shortly.

Listen to this insight

~ 12 minutes long

Last year delivered strong returns across fixed income markets. As we enter 2026, structural shifts – from fiscal policy dominance to blurring developed/emerging markets distinctions – will reshape opportunities. While credit spreads remain tight, selective positioning across diverse credit sectors may enhance income and portfolio resilience in this evolving landscape.

Key takeaways:

- Fiscal policy now drives markets as government spending overtakes central bank actions in shaping yield curves.

- Economic resilience supports credit despite tight valuations; focus on higher-quality below investment-grade sectors for enhanced income.

- Extending beyond traditional corporate bonds may add more attractive opportunities and diversify risk exposures.

- Emerging and developed markets distinctions are blurring, favoring sectors isolated from sovereign volatility.

2025 performance sets a strong foundation

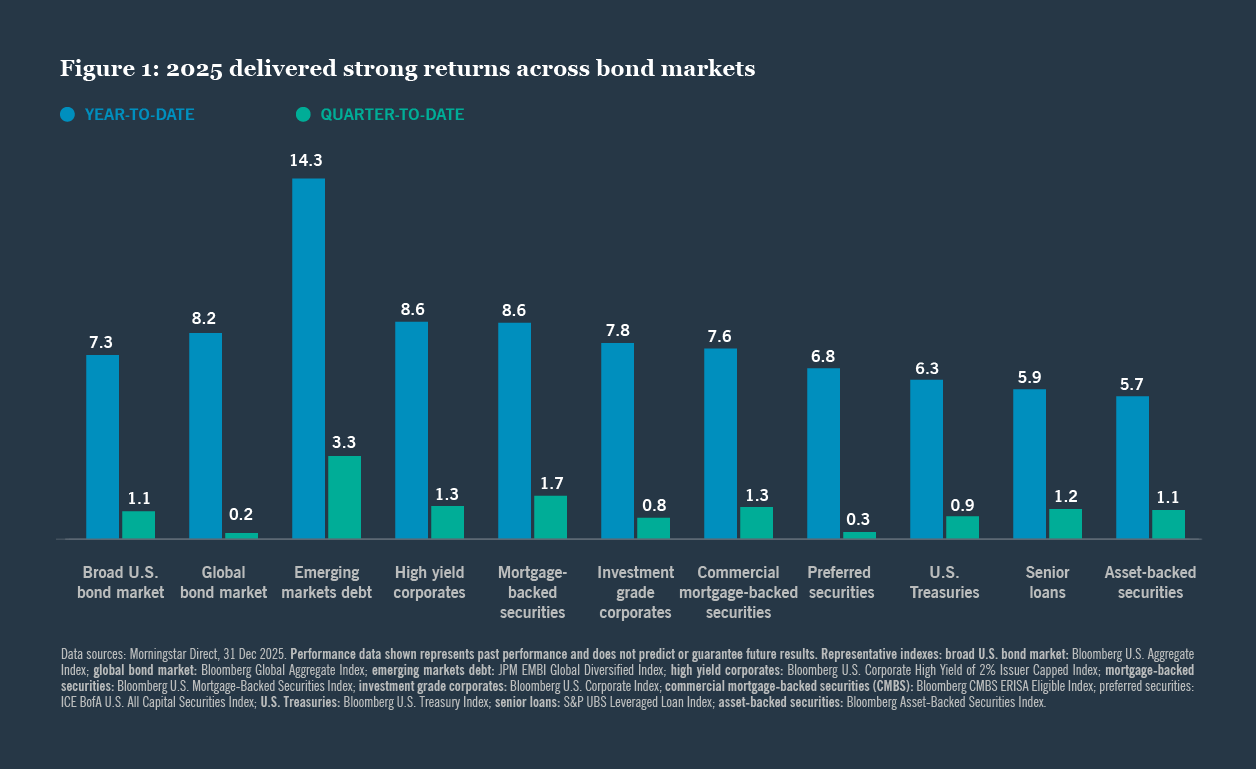

Despite early concerns over tariffs, 2025 proved exceptional for bonds. Falling rates and tightening spreads drove all major categories above 5% returns, with emerging markets leading at 14.3%. Fourth quarter gains were more modest but broadly positive, setting a solid foundation for the year ahead.

Four themes are shaping our approach

Four distinct forces are reshaping fixed income markets. The table below summarizes how we’re translating each theme into actionable portfolio strategy.

Time for a takeover: Fiscal over monetary

Central banks are nearing the end of rate-cutting cycles, and fiscal policy now dominates. Elevated deficits, demographic pressures, defense spending, industrial policy and green energy commitments will influence growth, inflation and yield curves across developed markets.

Large-scale government borrowing risks can push longer-term rates higher, particularly given already-elevated debt levels. Rather than extending portfolio duration aggressively, we favor positioning for moderately steeper yield curves by underweighting longer-duration bonds.

Economic resilience: Spreads tight, but room for credit risk

Our constructive global growth outlook remains intact – no recession is expected medium-term. Across developed markets, we expect faster growth in 2026 than 2025. We forecast U.S. GDP growth of 1.5% in 2025 (better than earlier estimates due to slower pass-through of tariffs) and 2.0% in 2026. Core PCE inflation moderates to 2.5%. Technology spending, accounting for roughly 20% of 2025 GDP growth, stays elevated as AI adoption boosts productivity. Supported by healthy balance sheets, corporate fundamentals remain strong.

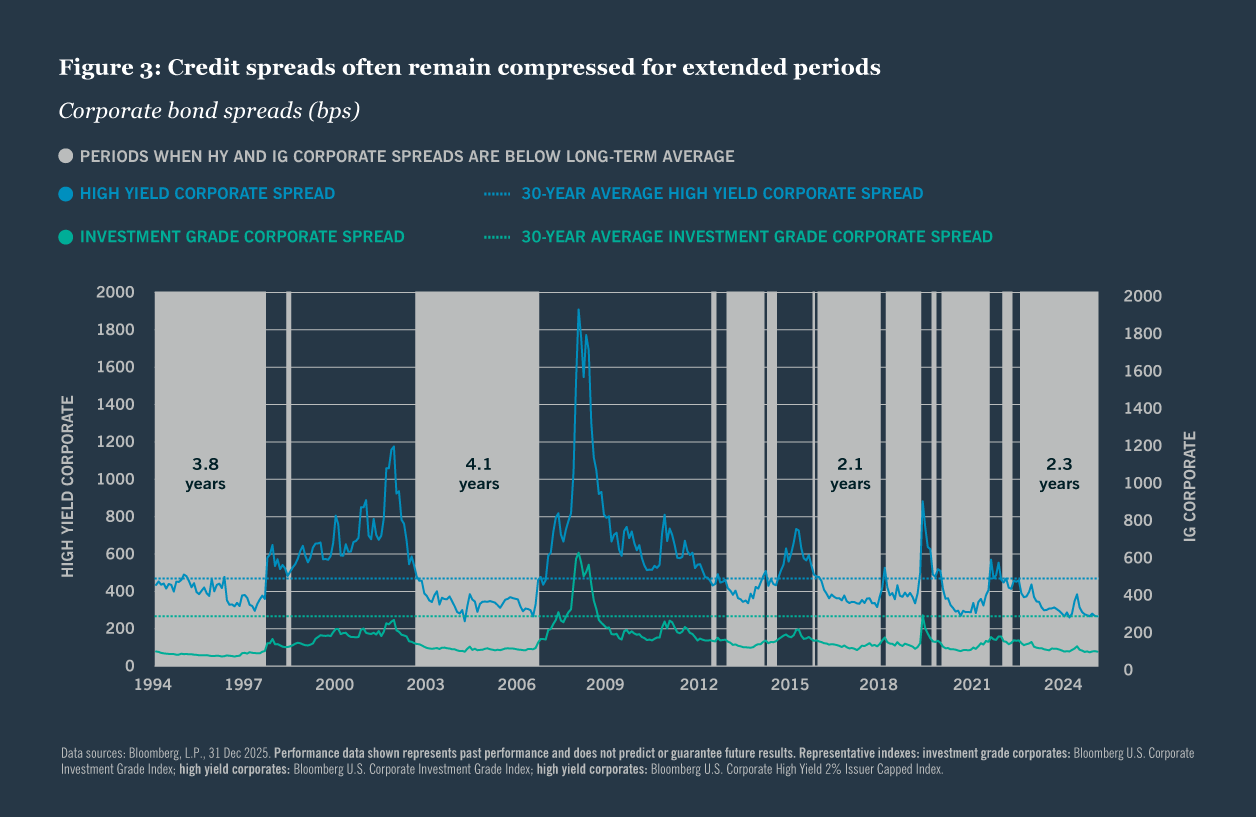

However, valuations are rich. Credit spreads – measuring extra income for credit risk – sit near historical lows. Spreads have remained below average for extended periods since 2012, interrupted only by brief volatility spikes (Figure 3). Derisking prematurely may sacrifice the income advantage credit sectors provide.

We balance tight valuations against income needs by favoring higher-quality segments of below investment-grade markets: BB and B rated high yield corporates, senior loans and preferred securities. This approach captures enhanced yield while maintaining moderate overall risk, avoiding the most vulnerable CCC rated segments.

Digging deeper for diversification: Look beyond traditional credit

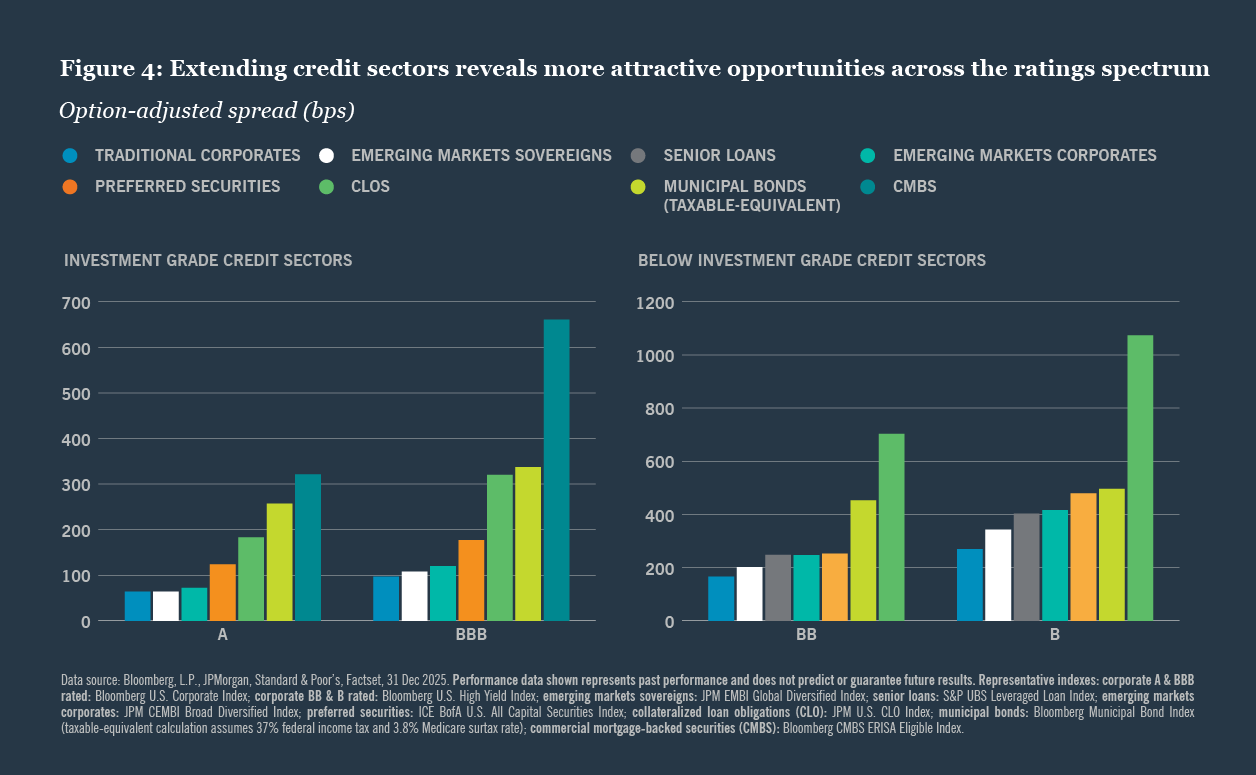

Strong inflows into fixed income markets have tightened credit spreads in conventional credit markets. We see better opportunities in lesser known sectors. These areas offer higher yield potential to compensate for different risk exposures and less active trading than in traditional sectors.

Commercial mortgage-backed securities (CMBS) – Backed by income-producing properties like medical offices, retail centers and multifamily housing.

Senior loans – Asset-secured corporate lending at the top of the capital structure, with floating-rate coupons reducing interest rate sensitivity.

Collateralized loan obligations (CLOs) – Pooled senior loans creating securities with varying risk levels.

Emerging markets debt – Government and corporate issuance from developing economies, offering higher-growth exposure with lower correlation to developed markets.

Preferred securities – Middle-tier corporate capital structure exposure, typically underrepresented in traditional fixed income portfolios.

Municipal bonds– Tax-exempt state and local obligations offering after-tax yield advantages for investors in higher tax brackets.

These extended sectors offer wider spreads than traditional corporates at comparable quality ratings (Figure 4). Their specialized nature makes them best accessed through professionally managed, diversified funds.

New playbook: Developed and emerging markets converge

Traditional distinctions between developed and emerging markets are dissolving. Political uncertainty, central bank independence questions and government stability concerns – once associated only with emerging economies – now apply to major developed markets.

Meanwhile, many emerging markets have strengthened fundamentals. Earlier and more aggressive inflation control, reduced debt burdens and more credible policy frameworks allow them to enter 2026 from a position of relative strength.

This convergence demands applying emerging markets analytical rigor to developed-market exposures — assessing political and institutional risks alongside traditional credit, rate, and currency factors. Active managers with robust emerging markets research capabilities are well-positioned for this integrated approach.

This shift has practical implications for portfolio construction: Favor sectors insulated from sovereign volatility. Securitized investments (MBS, ABS, CMBS) derive value from underlying collateral pools rather than government creditworthiness. Municipal bonds depend on state and local fiscal strength, providing separation from national political risk. High-quality emerging markets debt may now offer the diversification benefits developed markets traditionally provided, warranting higher strategic allocations.

Translating themes into portfolio strategy

Multisector fixed income strategies efficiently capture these themes within a single portfolio, using fundamental research to uncover opportunities across extended credit sectors and the full ratings spectrum while dynamically adjusting to evolving conditions.

- Multisector bond funds invest across the broadest range – investment grade through below investment grade – offering enhanced income potential and reduced interest rate sensitivity. They provide maximum flexibility to access the complete credit opportunity set: securitized sectors, senior loans, CLOs, preferreds and emerging markets debt. This latitude allows managers to dig deeper for diversification and include sizable allocations to many non-traditional credit sectors and emerging markets debt.

- Core plus funds maintain a traditional fixed income foundation while allocating up to 30% in higher-yielding plus sectors like high yield and emerging markets debt. This structure can deliver diversification and return enhancement while preserving moderate overall risk. Its risk profile allows ample opportunity to include the higher quality segments of the below investment grade markets to take advantage of economic resilience.

- Core bond funds invest broadly across investment grade sectors – Treasuries, securitized and investment grade corporates. Those with f lexibility for modest plus-sector allocations can capitalize on opportunistic credit exposures.

Outlook

Securitized markets and emerging markets present opportunities

Entering 2026, we expect U.S. real gross domestic product (GDP) growth to improve to 2.0%, a modest improvement from 2025’s expected pace. With stronger growth, the labor market should stabilize with unemployment near current levels. Inflation may face near term upside risk from pending tariffs but should moderate to around 2.5% core by year-end.

We expect the Fed to slow its pace of rate reductions but deliver an additional 50 bps of cuts through 2026. That would take the policy rate to 3.00%-3.25%, near our estimate of the “neutral” level. The European Central Bank should remain on hold before hiking rates in the second half of the year, while the Bank of Japan should raise rates at least once more this year.

We continue to modestly favor spread sectors and credit risk, with an up-in-quality bias. Credit spreads will likely remain volatile in the coming months, potentially creating more attractive entry points for risk taking. That said, we currently see opportunities in securitized markets — including commercial mortgage-backed securities and collateralized loan obligations — and in bonds from emerging markets economies poised to benefit from new trade policy. We expect Treasury yields to decline modestly and the yield curve to steepen throughout 2026.

Related articles

Markets stayed steady despite a Supreme Court tariff ruling, with Treasury yields rising modestly while spread sectors outperformed across the board.

Farmland, and specifically row crops, can add yield and inflation protection to portfolios.

If neither purely traditional fixed income and cash at one extreme nor overly equity-centric approaches at the other are optimal portfolio strategies, where do we see the most compelling opportunities? Our latest outlook covers this and more.

Endnotes

Sources

Inflation: U.S. Bureau of Labor Statistics Consumer Price Index for All Consumers. Employment: Bloomberg, L.P., Bureau of Labor Statistics, Nuveen. Global debt and yields: Bloomberg, L.P.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her financial professionals.

The views and opinions expressed are for informational and educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions, legal and regulatory developments, additional risks and uncertainties and may not come to pass. This material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections, forecasts, estimates of market returns, and proposed or expected portfolio composition. Any changes to assumptions that may have been made in preparing this material could have a material impact on the information presented herein by way of example. Performance data shown represents past performance and does not predict or guarantee future results. Investing involves risk; principal loss is possible.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. For term definitions and index descriptions, please access the glossary on nuveen.com. Please note, it is not possible to invest directly in an index.

Important information on riskInvesting involves risk; principal loss is possible. Debt or fixed income securities are subject to market risk, credit risk, interest rate risk, call risk, derivatives risk, dollar roll transaction risk, and income risk. As interest rates rise, bond prices fall. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity, and differing legal and accounting standards. These risks are magnified in emerging markets. Preferred securities are subordinate to bonds and other debt instruments in a company’s capital structure and therefore are subject to greater credit risk. Certain types of preferred, hybrid or debt securities with special loss absorption provisions, such as contingent capital securities (CoCos), may be or become so subordinated that they present risks equivalent to, or in some cases even greater than, the same company’s common stock. Asset-backed and mortgage-backed securities are subject to additional risks such as prepayment risk, liquidity risk, default risk and adverse economic developments. Non-investment-grade and unrated bonds with long maturities and durations carry heightened credit risk, liquidity risk, and potential for default.

Municipal bond income is generally exempt from regular federal income tax and may be subject to state and local taxes, based on the investor’s state of residence, as well as to the federal alternative minimum tax (AMT). Capital gains, if any, are subject to tax. Income from municipal bonds could be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the Internal Revenue Service or state tax authorities, or noncompliant conduct of a bond issuer. Please contact a tax advisor regarding the suitability of tax-exempt investments as this information should not replace a client’s consultation with a financial/tax professional regarding their tax situation. Nuveen and its investment specialists do not provide tax advice

Any investment in collateralized loan obligations or other structured vehicles involves significant risks not associated with more conventional investment alternatives. CLO liquidity risk is when during periods of limited liquidity and higher price volatility, a CLO issuer’s ability to acquire or dispose of Collateral Obligations at a price and time that the issuer deems advantageous may be severely impaired. Loan risk is the lack of an active trading market for certain loans may impair the ability of the strategy to realize full value in the event of the need to sell a loan and may make it difficult to value such loans.

Senior loans may not be fully secured by collateral, generally do not trade on exchanges, and are typically issued by unrated or below-investment grade companies, and therefore are subject to greater liquidity and credit risk.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Nuveen, LLC provides investment solutions through its investment specialists.

This information does not constitute investment research as defined under MiFID.

Contact us

Financial professionals

Individual investors

You are on the site for: Financial Professionals and Individual Investors. You can switch to the site for: Institutional Investors or Global Investors

Please be advised, this content is restricted to financial professional access only.

Login or register as a financial professional to gain access to this information.

or

Not registered yet? Register