TOOLS

Login to access your documents and resources.

Insatiable AI demand, colliding with capacity constraints, has propelled technology stocks to record highs and lifted broader equity benchmarks. Yet investors are questioning the durability of this uptrend. Many stocks are trading at peak valuation multiples; however, solid earnings growth is providing a cushion. The Magnificent 7 group of big U.S. tech stocks remain pivotal in portfolios, driving 68% of incremental earnings in the S&P 500 over the past decade. And with a one-third weight in the S&P 500, the ongoing double-digit earnings expectations of these companies continue to anchor market leadership.

Still, investors are closely watching whether extraordinary AI capital spending delivers tangible returns. While robust demand shows little sign of fading, scrutiny is intensifying, and potential disruption from new entrants underscores the risk of concentrated positions. High barriers to entry may protect incumbents, but the possibility of innovation reshuffling winners and losers makes selectivity in portfolios essential.

Valerie Grant, CFA, managing director and equities portfolio manager at Nuveen, shares her thoughts on how the relationship between AI and U.S. exceptionalism is unfolding.

Q) Do you see today’s U.S. equity strength as a reflection of productivity gains from AI, or primarily as a function of liquidity, fiscal expansion and capital crowding into a perceived safe haven?

AI is important, but it is not the only driver of equity markets right now.

Productivity gains from AI and the rapid adoption of AI across various sectors of the economy are important catalysts. For some sectors, we see the catalyst has been better-than-expected margins and in other sectors the impact is most obvious in stronger-than-expected revenue growth. To improve margins, companies are deploying AI to reduce and optimize inventory levels, automate online and in-person transactions, improve the speed and lower the cost of software development and enhance customer service. The impact on topline performance is most evident in the technology, communication services and industrial sectors where we have seen significant revenue growth in semiconductors, infrastructure software, online advertising and data centers.

While investor focus remains on AI, other themes are driving value creation as well, including the modernization of the defense sector and a gradual recovery in residential real estate. In financials, banks and investment firms are performing well due to favorable capital markets environments.

The concept of the U.S. as a safe haven is being tested given the country’s fiscal deficit and volatile policy landscape

Q) Let’s drill down on the tech sector. Why is the tech sector so important for U.S. equities relative to other markets around the world?

The tech sector is particularly important for U.S. equities because it accounts for such a significant percentage of the investable universe. The concept of the U.S. as a safe haven is being tested given the country’s fiscal deficit and volatile policy landscape; however, investors will struggle to achieve similar returns in tech sectors outside the U.S.

Let’s define what we mean by tech. From an investment lens, it includes the technology sector and the communication services sector. The technology sector is made up of software, semiconductors and electronic equipment. Examples include Nvidia, Broadcom and Microsoft. The communication services sector comprises of telecommunications, media and entertainment, and this is where you find firms like Alphabet and Meta.

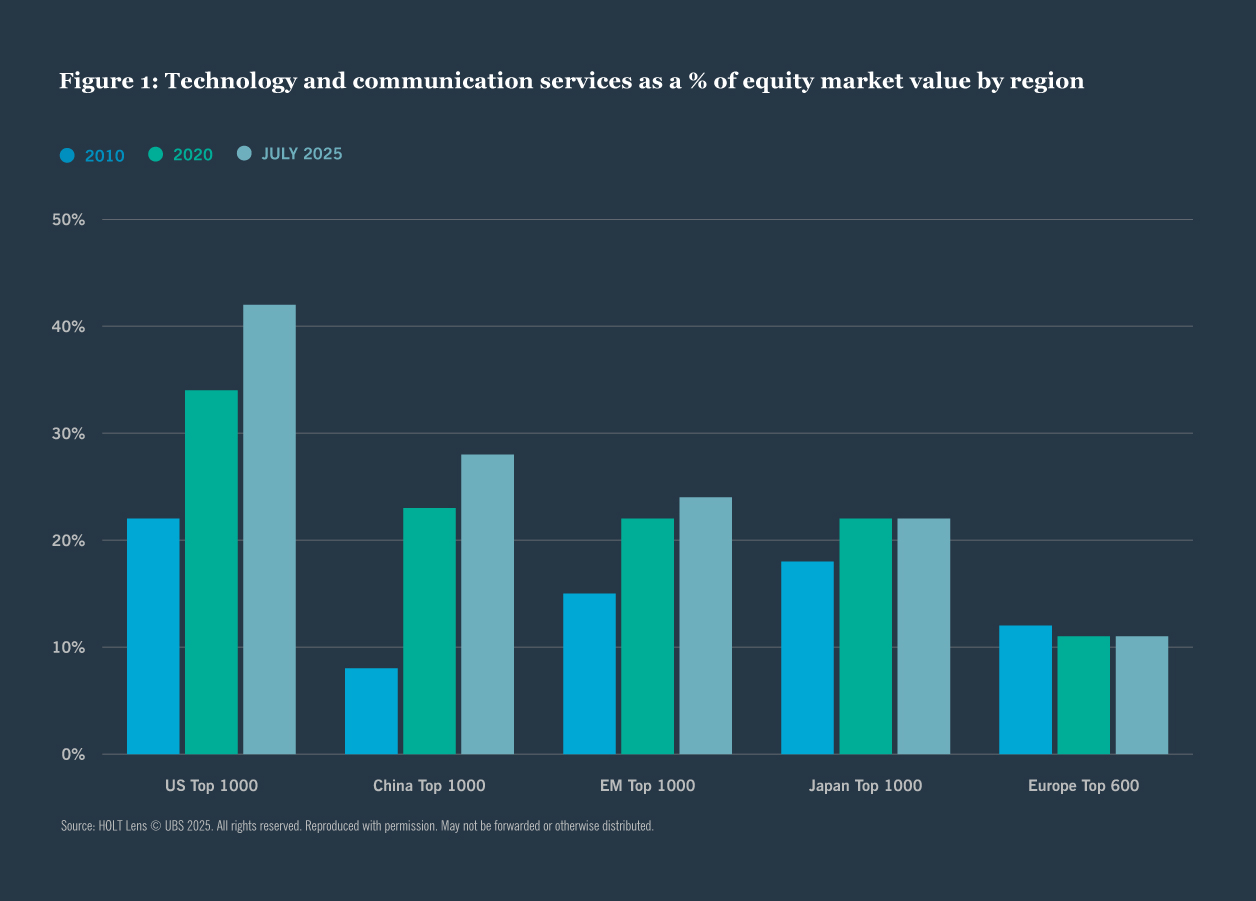

These two sectors dominate the U.S. equity markets to a far greater degree than they do in other parts of the world. Technology and communication services account for 48% of the broad market in the U.S. versus 28% in China and 11% in Europe. The difference is staggering particularly when you consider that the share was 22% in the U.S. just 15 years ago.

Q) To what extent do you believe the current AI-driven capex cycle is translating into sustainable revenue growth rather than just hype? And how do you weigh the risk that extraordinary AI spending delivers subpar returns, particularly as investors scrutinize monetization timelines?

Revenue growth is just the beginning of the value creation flywheel for the Magnificent 7. The question is whether the current AI driven capex cycle is delivering sustainable economic returns, not whether it is delivering sustainable revenue growth.

Using the cash flow return on investment as a proxy for economic returns, our analysis shows that the economic returns of the Magnificent 7 far exceed those of the broader market and have increased dramatically over the last 20 years.

Over time, these returns will normalize; however, our research suggests that we are still in the early innings of the adoption of AI in the enterprise segments of the market. As companies outside of the tech sector define, evaluate and adopt use cases for AI, the demand for inference and training models will increase, and the returns generated by companies that enable those use cases will increase.

China is transforming from a manufacturing hub into a leading force in research and development

Q) Given the Magnificent 7’s outsized contribution to earnings and market cap weight, are we in a fragile leadership regime—or can they continue to justify valuations through double-digit growth? Do you see valuation risk as a ceiling, or does earnings momentum make this sustainable?

Valuations do not appear to be a risk right now because six of the seven companies in the Magnificent 7 generate strong free cash flow and are self-funding. This is also true for large-scale data centers that are not in the Magnificent 7. The market is currently pricing in a deceleration in capex starting in 2026 and that would lead to an upward inflection in free cash flow from that period forward. We will be closely monitoring capex spending as well as AI adoption as companies report earnings during the balance of this year and next for signs of dislocation.

Q) Do you view U.S. tech dominance as structural or cyclical in nature, especially given geopolitical and regulatory risks?

Right now, the U.S. is in an enviable position because of the size and growth of the technology sector. U.S. exceptionalism implies that U.S. equities will dominate global capital markets forever; that is not a given – China is a formidable competitor.

The tech sector is increasing as a share of total market capitalization in China. In certain industries, China is pulling ahead. This includes electronic vehicles, autonomous driving and life sciences. Along with the tech sector, it is important to monitor innovation in the biotechnology sector, where Chinese companies have experienced remarkable success. In China and the Asia-Pacific region more broadly, the public sector is increasing funding for research and development in the biotechnology sector. This inflection in investment is important because it signals that China is transforming from a manufacturing hub into a leading force in research and development. It will enable China to improve the health and quality of life of its population for decades to come and to export innovative medicines to other parts of the world.

So, based on the direction of travel, China presents the most significant external threat to U.S. exceptionalism. From an investment perspective, we must stay on top of what is happening in China because for large-cap U.S.-listed companies, China represents either an important geography in supply chains or a market for products and services, or both. We are actively monitoring the evolution of geopolitical risks and considerations that may impact the investment performance of our holdings over time.

Q) In a world where fiscal deficits, tariffs and higher for-longer rates remain, do you see the U.S. retaining its premium relative to global equities?

If the technology and communication services sectors maintain their vitality, the U.S. should retain its premium relative to global equities. The risks to that occurring are both internal and external. The primary internal risk is a shock to the economy precipitated by fiscal or monetary policy that leads to a reacceleration of inflation and disruption in the capital markets. The main external risk is the emergence of China as a technology leader with the capacity to rival the Magnificent 7.

Related articles

U.S. high yield corporate bonds feature an attractive combination of solid credit quality, ample liquidity and low default rates.

Chair Powell avoided signaling a clear near-term policy path, saying the Fed is “well-positioned to determine the extent and timing of additional adjustments.”

Institutional investors globally, whether or not they have net zero commitments, are eager to align with and prepare for the energy transition.