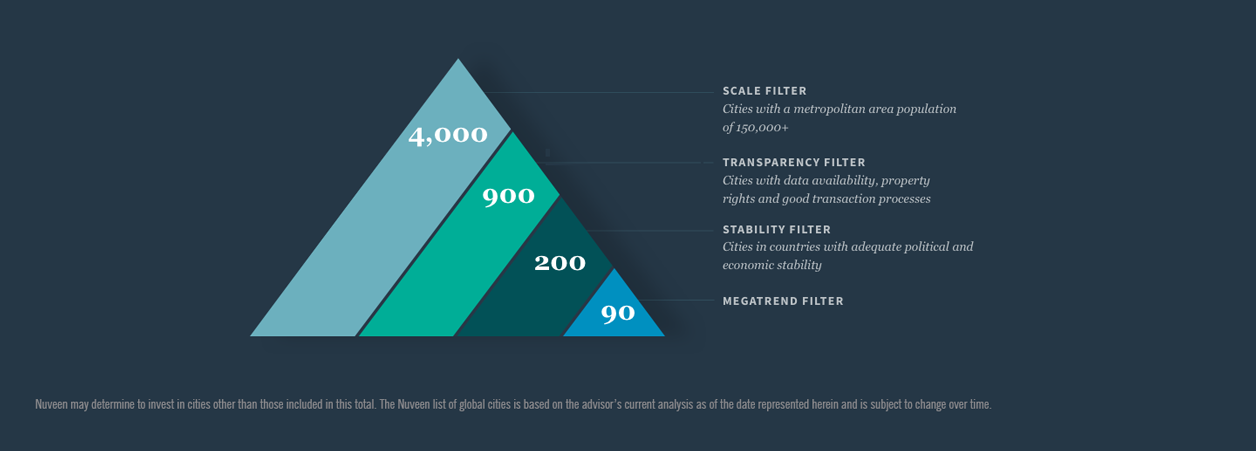

A global strategy focused on providing sector diversification by targeting commercial real estate in the cities that we believe are best positioned to benefit from demographic and structural megatrends.

TOOLS

Login to access your documents and resources.

Investing in global cities

Real Estate Insights

Europe’s real estate renaissance?

Read our latest thought leadership piece on why investors should now consider European opportunities, and why this may be Europe’s renaissance.

Stefan Wundrak

As of 31 December 2024, Nuveen assets under management (AUM) is inclusive of underlying investment specialists.

Years of real estate investing experience as of 31 Dec 2024

Top 5 real estate manager globally based on Pensions & Investments, Oct 2024. Rankings based on total worldwide farmland assets under management as of 30 Jun 2024 as reported by each responding asset manager; updated annually.

Total real estate employees includes 360+ real estate investment professionals, supported by a further 410+ Nuveen employees.